Achieving Financial Independence: Strategies for Lasting Success

Imagine a life where your choices are not dictated by a paycheck but by your passions and interests. Sounds enticing, right? This vision of financial independence isn’t merely a pipe dream. It can be your reality, if you are armed with the right strategies. The journey toward financial independence is a transformation that requires not just a plan, but a radical shift in mindset and approach.

Personal Journey Meets Collective Aspirations

My journey began with the universal struggle to make ends meet while juggling numerous responsibilities. Like many, I found myself enveloped in a vicious cycle where each month was a race against time and bills. Yet, as I navigated through this, I recognized a pattern: the struggle wasn’t just personal, but a shared dilemma faced by millions trying to gain control over their financial lives.

Realizing this, I decided to turn my insights into actionable strategies, understanding that financial independence is not a solitary aim but a collective pursuit. The lessons learned can illuminate the path for others, creating a community focused on empowerment and shared growth.

Questioning Conventional Wisdom

Traditionally, we have been taught to climb the corporate ladder to gradually secure financial stability. However, this standard pathway often leads to burnout and dissatisfaction. It is essential to challenge this notion: is your job truly securing your financial future or is it shackling you to a system?

Instead of focusing solely on income, we should embrace a dual approach of increasing revenue streams while minimizing liabilities. The harsh truth is that many careers today are transient. Therefore, maintaining financial independence requires a shift toward entrepreneurship, investment, and skill diversification.

Interdisciplinary Approach to Financial Independence

To truly understand how to achieve financial independence, we must draw insights from various fields. Psychology teaches us about behavioral finance, emphasizing the need to control emotional spending. Philosophy reminds us to focus on what truly brings happiness, steering investments toward meaningful experiences rather than material possessions.

By integrating technological advancements, such as automated savings apps and investment platforms, we can optimize our financial decision-making processes. Embracing these developments can create a more streamlined approach to managing finances and increase our overall wealth.

Forecasting Future Trends

As we look to the future, we see an evolving landscape of work, technology, and societal norms. Remote work is no longer the exception but the expectation, allowing us to rethink our relationship with labor and income. This shift presents an opportunity to generate income from various locations and sources, thus diversifying and securing our financial future.

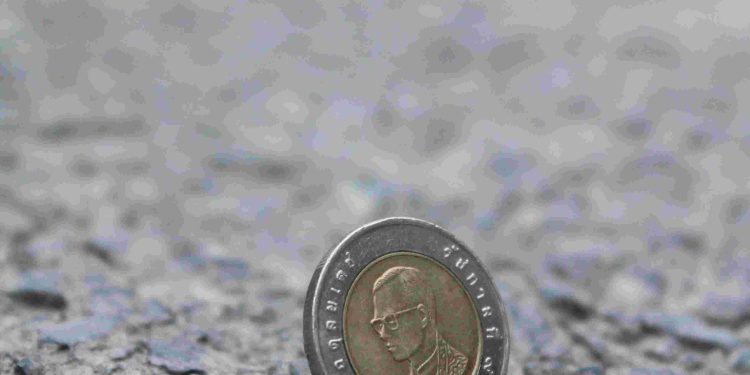

Moreover, the world of cryptocurrency and decentralized finance is blossoming, offering a new frontier for wealth accumulation. Understanding these trends and being prepared to navigate them effectively can position you ahead of the curve in achieving financial independence.

Practical Steps towards Financial Independence

Now that we’ve set the stage, let’s delve into actionable strategies that can lay the groundwork for your path to financial independence:

-

Develop a Comprehensive Budget:

Begin by tracking your income and expenses. Use budgeting tools or apps to visualize your financial landscape and identify areas for improvement. -

Diversify Income Streams:

Explore side hustles, investment opportunities, or passive income channels. A multifaceted income approach protects against economic fluctuations. -

Invest Wisely:

Allocate funds into stocks, real estate, or other assets that appreciate over time. Focus on long-term gains rather than quick wins. -

Stay Educated:

The financial world is ever-changing. Commit to continuous learning through books, podcasts, and courses that enhance your knowledge and skills. -

Network and Collaborate:

Surround yourself with like-minded individuals who share your aspirations. Collaboration can lead to new opportunities and perspectives.

Crafting a Narrative of Financial Resilience

The journey toward financial independence can often feel daunting, but viewing it through the lens of a narrative can embolden your pursuit. Each financial mistake becomes not a failure, but a stepping stone towards greater wisdom. Living within your means becomes less about restriction and more about choosing freedom.

Utilize metaphors to clarify complex ideas—think of your financial journey as building a solid house. The foundation, much like your savings, needs to be robust before you can add the walls and roof, signifying your investments and income streams. As with any structure, the more time and effort invested at the foundation stage, the sturdier the outcome.

The Imperative of Lifelong Learning

In a world that is constantly evolving, the importance of continuous education cannot be overstated. From attending workshops on financial literacy to engaging in forums discussing investment strategies, every moment invested in learning serves to fortify your financial acumen.

Diving into new subjects can unveil opportunities that were previously hidden, serving as a catalyst for growth and innovation in your financial strategies. This also opens a door to innovation, allowing you to adapt and remain relevant in changing market dynamics.

Taking Action: Your Roadmap Awaits

Reflecting on these strategies, it is clear that the journey toward financial independence is not just about numbers; it’s about building a life where passion and purpose take precedence over financial stress. Your roadmap is waiting, and now is the best time to take that leap forward.

Start today by drafting your financial goals, breaking them down into achievable milestones. Create a vision board, seek accountability through a mentor, or join community groups focused on financial literacy and support—each step forward brings you closer to the financial freedom you’ve envisioned.

Embracing Critical Thought

Finally, as you embark on this journey, embrace critical thinking. Do not accept mainstream financial advice at face value. Instead, question it, analyze it, and curate a strategy that resonates with your unique aspirations and circumstances. The path to financial independence is not one-size-fits-all; it is a tapestry woven from your distinct experiences, challenges, and victories.

As you continue to evolve in your understanding of finance and independence, remember: this is more than just a goal; it’s a lifestyle that fosters freedom and fulfillment.