Expert Guidance for Life Insurance Planning

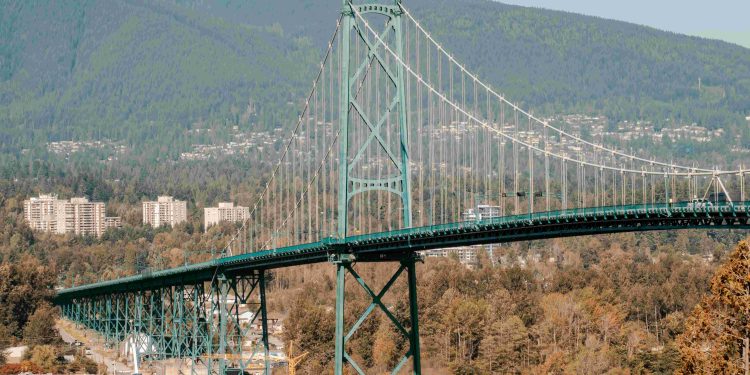

Imagine this: you wake up one morning to a world where security isn’t just optional, but fundamental. For centuries, humans have sought ways to protect their families, ensure futures, and leave lasting legacies. While life insurance may seem like just another checkbox on an endless to-do list, it’s far more profound—it’s a bridge to stability in an uncertain world. The real question is, are we approaching it with the depth and foresight it demands?

Breaking the Myths of Life Insurance

Life insurance often gets shrouded in misconceptions. Many see it as either unnecessary or a luxury reserved for certain stages of life. However, this conventional wisdom is worth challenging. Life insurance isn’t just for those with dependents; it’s a cornerstone of financial resilience. In the age of economic disruptions and rapid societal shifts, its purpose goes beyond merely covering funeral costs or replacing income—it’s about safeguarding ambitions and ensuring continuity of dreams.

Consider this comparison. Just as a smart investor doesn’t merely aim to beat the market but to create lasting wealth, life insurance isn’t about short-term benefits. It’s about establishing a safety net that adapts and evolves with your life and your loved ones’ long-term needs.

The Personal Lens: My Story of Financial Awakening

A few years ago, I found myself in a crossroads moment. A close friend, who had built an enviable career and life, passed away unexpectedly, leaving their family grappling not only with immense grief but also overwhelming financial uncertainty. It was a conversation I had with his spouse that awakened me to the gaps in my own planning. She said, “I always thought we had time.”

That conversation led me down an introspective journey, one that blended personal responsibility with broader societal observations. We often think of financial planning as something static—a set-and-forget checklist. Yet, this static approach doesn’t align with life’s dynamic nature. So, I began studying the philosophies of futurists, cognitive biases, and decision-making frameworks to reframe how I approached life insurance, viewing it not as a transaction but as an evolving tool of empowerment.

Technology’s Role in Shaping Future Insurance Trends

The digital era is disrupting every industry, and life insurance is no exception. Artificial intelligence, machine learning, and big data analytics are revolutionizing risk assessment and policy customization. Imagine a world where your wearable device not only tracks your health but provides real-time adjustments to your life insurance plan based on your activities, improving premiums as you develop healthier habits.

This isn’t distant science fiction—it’s an imminent paradigm shift. Actuarial models are now equipped to capture nuances in human behavior, making coverage more personalized than ever. The future of life insurance will be agile, predictive, and integrative. It’s an exciting development, but it also raises critical questions about data privacy and ethical boundaries. As consumers, we must remain informed and vigilant to ensure technology serves our best interests without compromising our rights.

Practical Strategies for Effective Life Insurance Planning

Here are some actionable steps to approach life insurance planning with clarity and confidence:

-

Assess Your Needs:

Begin with a holistic review of your current financial situation, family dynamics, and future goals. What are you protecting? Who depends on you? -

Understand Policy Options:

Don’t settle for the standard offerings. Explore the spectrum—from term and whole life policies to universal and indexed insurance. Tailor your choice to meet your unique needs. -

Consult Professionals:

The complexity of modern financial instruments demands expert insight. An advisor can provide nuanced recommendations that align with your life stage and income level. -

Revisit Plans Periodically:

A policy purchased five years ago might not be relevant today. Major life events—marriage, having children, career changes—demand regular reevaluations of your coverage. -

Plan Holistically:

Incorporate life insurance into a broader strategy that includes retirement savings, investments, and estate planning. Think beyond immediate needs and towards long-term financial independence.

Life Insurance as an Expression of Legacy

In his renowned book

Man’s Search for Meaning

, Viktor Frankl wrote that “life is never made unbearable by circumstances, but only by lack of meaning and purpose.” When we think about life insurance, we should consider not just its financial utility but its role as an extension of our life’s purpose. Beyond dollars and cents, every policy is a statement of what and who matters most to us.

For example, policies with a charitable component can ensure your passions live on. Others might shape the educational futures of the next generation, solidifying family values for decades to come. In this way, life insurance becomes not just a tool for protection, but a vehicle for significance and influence.

Challenge the Status Quo and Take Action Today

Life insurance planning isn’t a task to procrastinate. Every day we delay is a day our families remain vulnerable. The barriers to entry are no longer financial or procedural—they’re psychological. Many of us fear confronting our mortality or making long-term commitments. But in doing so, we underestimate our own resilience and our ability to plan strategically.

Embrace life insurance as more than an obligation; see it as an opportunity to act with foresight and conviction. Whether you’re a young professional starting out or a seasoned executive considering your legacy, today is the best time to begin—or revisit—your plan. Confronting tough questions now equips you and your loved ones with reassurance and peace of mind for the uncertainties ahead.